Many students struggle with debt and find it difficult to balance their finances; here are our top tips to help you avoid debt.

Remember there is unavoidable debt from student fees – the good news is this does not need to be paid back until you are earning £25,000 a year and will be taken out of your salary by your employer so you don’t need to worry too much about them.

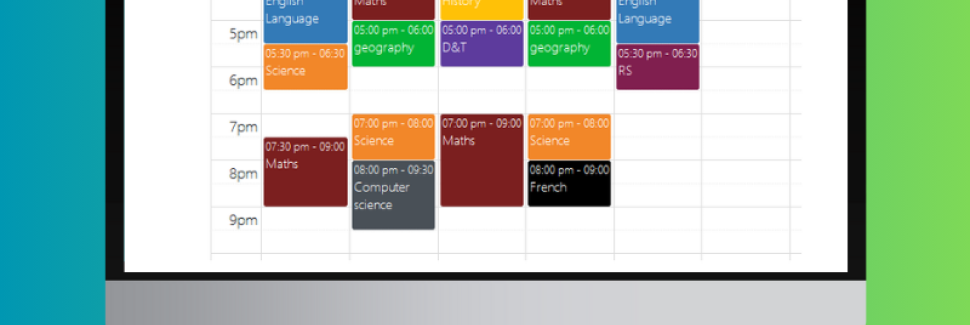

Create a spreadsheet of all your costs

Sounds very boring and business like but you can’t avoid debt without working out your costs – a top tip here is to work out an annual figure. Make sure you include: Rent, food, clothing, bills etc. but don’t forget seasonal costs such as birthdays and Christmas.

Know your income

Most people know their headline salary –For example you’re on £20,000 a year or £8.50 per hour but remember the taxman comes and takes away income tax and national insurance – so work out what you earn after all taxes, student fees and loans etc. are taken out.

If you are receiving student loans then they can be treated as an income on your calculations but they must be paid back!

Balance your books

If you find you are earning less than you are a spending then you need to make some tough choices to avoid debt. Essentially you either need to increase your income or cut back on your spending.

Increasing your income

Can you get a raise from your boss or ask for more hours. Do you have the skills and experience to apply for higher paying jobs? Earning more money is easier said than done but should be looked at closely to avoid debt.

Cut your spending

Fixed costs like rent are easy to calculate; other costs such as heating bills are seasonal but should be looked at as a way of cutting down costs. The easiest way to cut costs is to look at what you are purchasing – always ask yourself do I really need this when considering a purchase. You be surprised as to how disciplined you can be if you think about what you are buying before making the purchase.